Harry

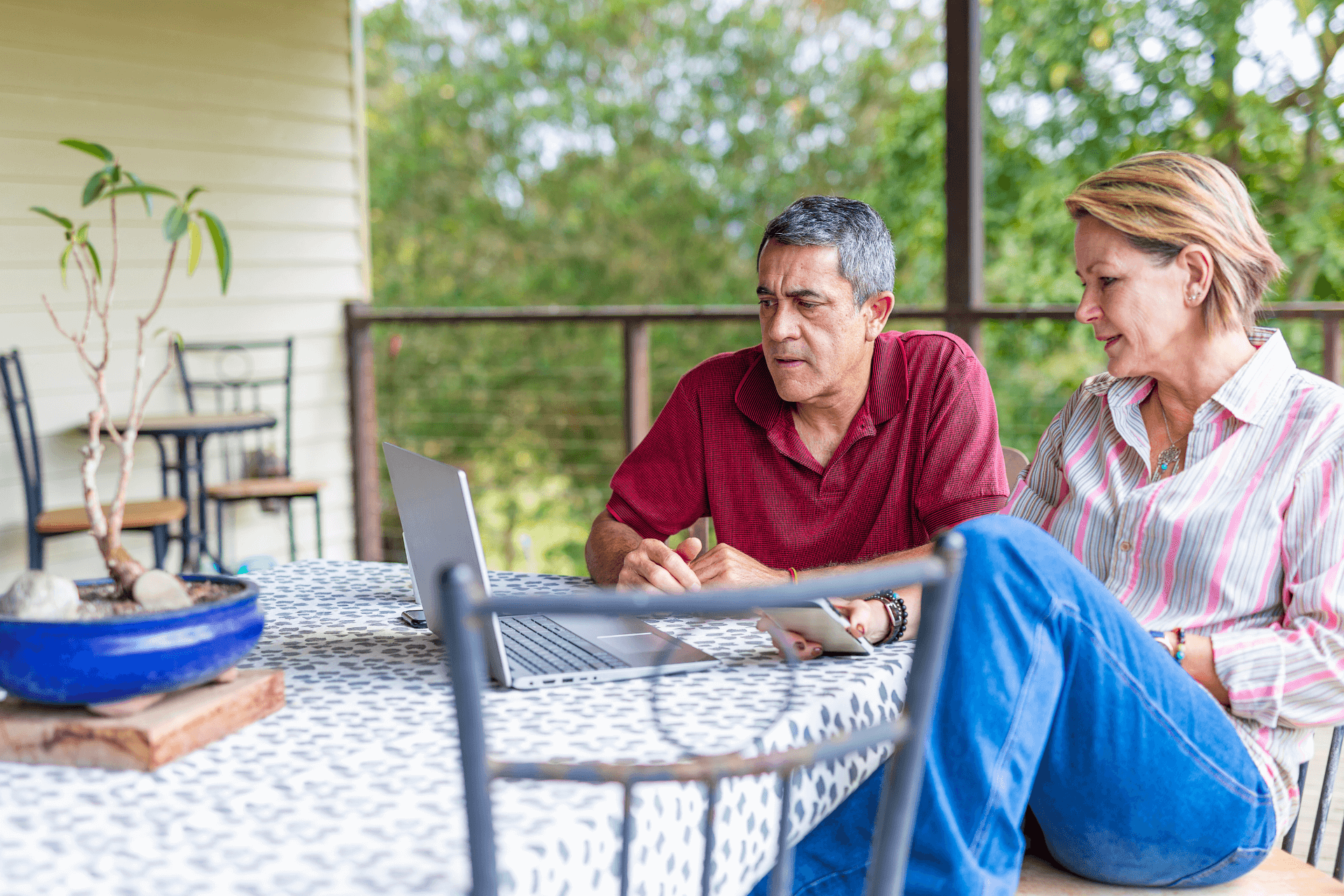

Harry* had his superannuation in an industry fund for decades. Out of nowhere, he received a ‘cold call’ suggesting that he transfer his super into a self-managed superannuation fund, and was led to believe that by doing so, he would retire with a higher balance. Unfortunately, Harry was given bad advice, and his superannuation was invested against his goals and risk profile. As a result, Harry and his wife lost over $360,000.

“I thought I was doing the right thing, but in hindsight, as we put the puzzle pieces together for our AFCA complaint, all the red flags became apparent,” said Harry.

The CSLR found Harry eligible for compensation and he received $150,000 in May 2025. “We are incredibly grateful to receive the compensation; however deciding how to make these funds work for us so that we can retire with anything close to what we lost, is something we’re still working through,” Harry explained.

Despite having found a new financial adviser that they feel comfortable with, Harry and his wife say that placing trust in anyone to help manage their retirement savings has been very challenging after what they’ve been through.

*name changed for privacy