The Compensation Scheme of Last Resort (CSLR) is an important piece of the external dispute resolution (EDR) framework in Australia. It was recommended by the Ramsay Review to “promote trust and confidence in the EDR framework and the financial services sectors more broadly” and was supported by the Financial Services Royal Commission.

The scheme is funded by industry, with maximum individual compensation claims of $150,000 available for eligible AFCA determinations of financial misconduct relating to personal financial advice, credit intermediation, securities dealing or credit provision.

The CSLR legislation passed by the Australian Parliament in June 2023, sets out the annual levy process. The Levy Act 2023, Levy Regulations 2023 and Levy (Collection) Act 2023 determine how estimates are calculated and levied on the relevant financial services sectors.

Overview

CSLR is funded through a levy on four defined sub-sectors of the financial services industry, specifically:

- credit intermediaries

- credit providers

- licensees providing financial advice

- securities dealers.

Levies are scaled to the size of each financial firm.

The levy model is set out in:

- legislation passed by the Australian Government

Levy process

The following steps must occur before ASIC can invoice the levies:

- CSLR calculates the levy estimate for each period in advance.

- The estimate is recorded on the Federal Register of Legislation as a 'legislative instrument' alongside an explanatory memorandum.

- The instrument is tabled in each House of Parliament.

- Each House of Parliament is served with a 15-day Disallowance Period.

- Once the Disallowance Period is over, ASIC determines the levy portion for each financial firm. The levy is based on subsector caps and the firm's size.

- ASIC sends an invoice to each firm and collects payment for the Government.

Financial sub-sector caps

The total annual levy that may be imposed for any levy period across all sub-sectors must not exceed $250 million.

The sub-sector levy cap is $20 million for each sub-sector.

Unless the Minister exercises their discretion to raise a ‘special levy’, this sub-sector levy cap of $20 million is the maximum levy that may be imposed during the annual levy period for all sub-sector members.

How levies are calculated

As required by law, CSLR estimates the costs to fund the scheme during the upcoming levy period.

The CSLR engages an independent actuarial consultancy as Principal Actuary.

The Principal Actuary recommends an estimate of costs by:

- conducting detailed modelling and analysis

- following legislative and regulatory compliance.

A second independent Reviewing Actuary reviews the estimate determined by the Principal Actuary as a quality assurance mechanism.

The Principal Actuary produces an independent report for each estimate, which we publish.

Levy types

The legislative framework outlines the levies that can be used to fund the CSLR scheme.

Late payments can result in penalties and other consequences.

Pre-CSLR

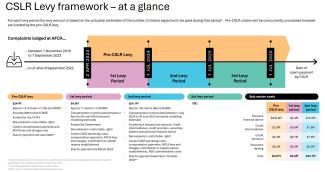

The pre-CSLR complaints levy was the first estimate made by the CSLR Board after the legislation was passed to fund expected claims and costs of the backlog of AFCA-paused complaints awaiting the legislated scope of CSLR.

Who Pays | Coverage | Period |

| The 10 largest banking and general/life insurance groups (based on income from the 2021–22 financial year). | Eligible AFCA complaints, including:

| Complaints lodged with AFCA before 8 September 2022 (regardless of when CSLR receives the claim). |

Read more about the pre-CSLR complaint estimate.

Annual levy

The annual levy is funded by the industry subsectors specified in the legislation. The exception is the first year, funded by the Australian Government.

First levy period

Who pays | Coverage | Period |

| Australian Government | The levy includes:

| 2 April–30 June 2024 |

Second levy period

Who pays | Coverage | Period |

| Industry subsectors | The levy includes:

| 1 July 2024–30 June 2025 and subsequent years |

Further levy

If claims and costs significantly exceed the initial estimate at the time it is determined, a further levy may be required. This levy can apply to one or more financial industry sub-sectors.

Further levies are capped at $20 million per subsector. As set by law, total annual levies can't exceed the cap.

Who pays | Coverage | Period |

| Industry subsectors | The levy includes:

| Full financial year |

Special levy

If an estimate significantly exceeds the $20 million subsector cap in a levy period, a special levy can apply.

The power to impose the levy resides with the Minister for Financial Services.

Who pays | Coverage | Period |

| Industry subsectors | The levy includes:

| Full financial year |

Role of other entities in the levy process

Treasury

Treasury advises the Government in the development of policy that becomes law.

The department was instrumental in the creation of CSLR.

Australian Securities and Investments Commission (ASIC)

ASIC is CSLR's oversight body. They ensure we perform our role according to the legislation and other requirements.

ASIC determines and collects the industry levy that funds CSLR.

Australian Financial Complaints Authority (AFCA)

AFCA handles consumer complaints about financial products and services where financial loss has occurred.

If a complaint can't be resolved, AFCA might award compensation. If a financial firm becomes insolvent during this process, consumers might be eligible for CSLR compensation.

AFCA also helps CSLR estimate costs and fees for the annual levy.